How Technology is Transforming the Loan Application Process

In the past, obtaining a business loan was a cumbersome process that often involved lengthy paperwork, endless meetings with bank officials, and weeks of waiting for approval. The traditional loan application process was time-consuming and intimidating for many entrepreneurs, especially those new to the business world. However, the landscape of financial services has transformed significantly with the advent of technology. From AI-driven credit scoring to blockchain-enabled secure transactions, technological advancements are reshaping how loans are applied for, processed, and approved.

This article explores the impact of technology on loan applications, providing insights for tech-savvy entrepreneurs, fintech enthusiasts, and business professionals keen on understanding these developments. Our ultimate aim is to highlight how technology can be leveraged to ease and expedite the process of securing a loan for new businesses.

Historical Context

Traditionally, the loan application process was characterized by extensive documentation, in-person interviews, and reliance on human judgment for credit assessments. This system posed significant challenges for businesses, particularly new ones lacking substantial financial history. The process was often opaque and biased, with many companies struggling to meet stringent requirements and secure funding. The traditional methods were inefficient and excluded many potential borrowers from the financial ecosystem.

Current Technological Innovations

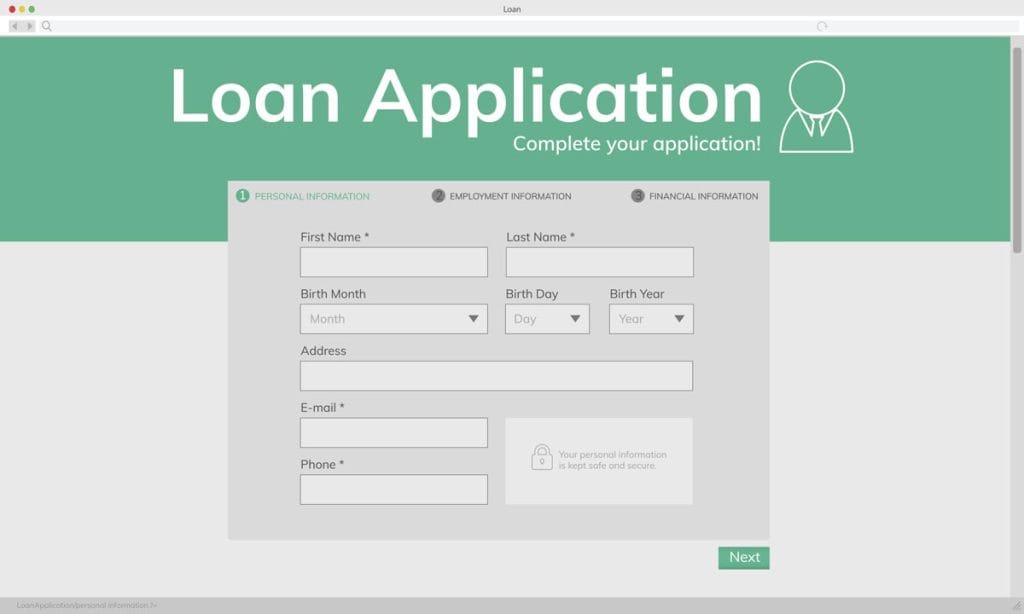

Technology has introduced many innovations that have transformed the loan application landscape. Digital platforms now play a pivotal role in streamlining the process, allowing applicants to fill out forms and submit necessary documents online, reducing the need for physical interaction and paperwork. Artificial intelligence and machine learning have further revolutionized the industry by enhancing credit scoring accuracy. Through analyzing vast datasets, AI can predict creditworthiness more efficiently and reasonably than traditional methods.

Meanwhile, blockchain technology is gaining traction in creating secure and transparent transaction processes. By using immutable ledgers, blockchain reduces fraud risks and provides a clear audit trail, offering peace of mind to both lenders and borrowers. These innovations have made the loan application process more efficient and accessible to a broader range of applicants.

How to Get a Loan for New Business: Tech’s Impact

Technological advancements have significantly simplified securing a loan for new business owners. Today, various online tools and platforms enable entrepreneurs to compare different loan products, interest rates, and conditions with just a click. This transparency empowers business owners to make informed decisions tailored to their needs. Fintech companies are at the forefront of this transformation, providing alternative lending solutions that bypass traditional banks.

These companies leverage technology to offer peer-to-peer lending, crowdfunding, and microloans, which are particularly beneficial for startups and small businesses that might not qualify for conventional loans. As a result, accessing capital for a new company has become more straightforward and less intimidating, encouraging innovation and growth in the entrepreneurial sector.

Impact on Loan Application Process

The integration of technology into the loan application process has led to a significant reduction in processing time. What once took weeks can now be accomplished in days or even hours. This speed benefits the applicants and enhances the customer experience by offering personalized services tailored to individual business needs. Moreover, technology has increased accessibility to loans, particularly for underserved markets and demographic groups that were previously marginalized. By breaking down geographical and socio-economic barriers, technology has democratized access to financial services, fostering greater inclusivity and economic opportunity.

Challenges and Considerations

Despite the numerous benefits, the digital transformation of loan applications is challenging. Security concerns remain a primary consideration, as the shift to online platforms increases the risk of cyber threats and data breaches.

Additionally, relying on decision-making algorithms introduces potential biases, as these systems can inadvertently perpetuate existing disparities if not properly managed and audited. Regulatory compliance is also challenging, as financial institutions must navigate complex legal frameworks to ensure ethical and lawful operations. Addressing these challenges is crucial to maintaining trust and integrity within the system.

Future Trends

Looking ahead, emerging technologies are set to revolutionize loan applications further. AI-driven customer interactions promise to enhance personalization, offering tailored recommendations and support throughout the application process. Innovations in blockchain technology are also anticipated to bolster security and efficiency in loan processing and management. As these technologies continue to evolve, they hold the potential to streamline further and democratize access to loans, empowering more entrepreneurs to realize their business ambitions.

To Wrap It Up

Technology has transformed loan applications, making the process more efficient, transparent, and accessible. Leveraging these technological advancements can provide better access to funding and support growth and innovation for businesses, particularly new ones. As the financial landscape evolves, embracing these changes will be key to staying competitive and thriving in a tech-driven world. Entrepreneurs are encouraged to explore these digital solutions to unlock new opportunities and secure the financial support they need to succeed.